Aug 15, 2024 / By Charles Sherry, MSc

Investors are aware that August and September sometimes bring volatility.

The S&P 500 Index closed at an all-time high on July 16. But like clockwork, weaker-than-expected manufacturing data led to a selloff on Thursday August 1, which was followed by a disappointing payroll report the following day.

The August 5 monumental selloff in Japan (12%) was blamed on the unwinding of the carry trade. The selloff spanned the globe. It was Japan’s worst one-day decline since October 1987.

It was the perfect storm.

As investors at home were unexpectedly buffeted by weak U.S. data, the Bank of Japan (BoJ) surprised investors on July 31 by raising its key rate from 0–0.1% to 0.25%, the highest since 2008. It didn’t rule out at least one more rate increase this year.

Moreover, the BoJ said it would gradually reduce its bond-buying program (QE) by about half over the next two years.

The carry trade had been a profitable bet by hedge funds and institutional investors, who had been taking advantage of the huge differential between rates in Japan and the rest of the world, including the U.S.

In other words, borrow in cheap yen to fund buys of tech stocks, cryptocurrencies, higher-yielding U.S. Treasuries (though Treasuries rallied during the selloff), Japanese stocks, and any other assets that might offer a positive return.

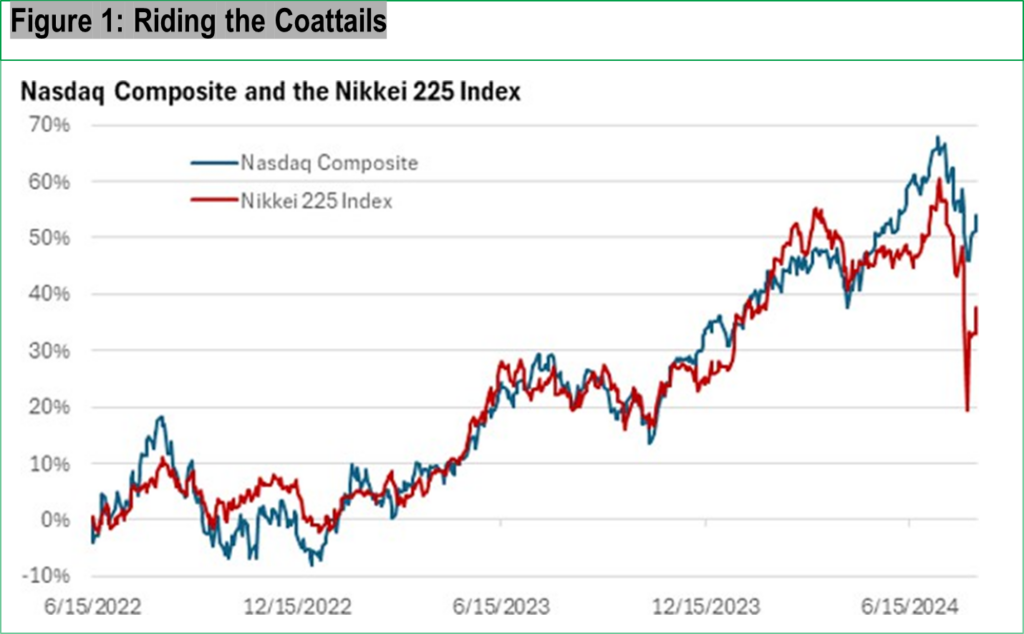

Note the close relationship between the tech-heavy Nasdaq and the Nikkei 225 Index over the past two years.

Data Source: Yahoo Finance 8/13/2024

Past performance is no guarantee of future results.

But asset managers were betting Japanese rates would not rise and a weak yen was a safe bet. They bet on stability.

But the yen suddenly snapped back, and margin calls forced liquidations in Japan and around the globe.

By midweek, the BoJ soothed frayed nerves by saying it won’t raise rates when markets are unstable.

Additionally, nascent recessionary worries at home began to subside, and JPMorgan said it estimates about three-quarters of the global carry trade has unwound.

Nevertheless, all of this occurred at probably the worst time—a deleveraging of over-leveraged trades when investors were on summer holiday.

But perspective is in order. While pullbacks are sometimes violent, they are a normal part of investing.

Since peaking, the S&P 500 Index’s most recent peak-to-trough decline is 8.5%. That’s not unusual. In fact, it would be unusual if it avoided a pullback of, say, 5- 6% during a calendar year.

The S&P 500 averages a 10% correction or greater every 12 months. Last correction: October 2023.

The final quarter of the year has historically been the best quarter for stocks. Recent market action is encouraging, but we are entering an uncertain period. Investors are cautiously bracing for the fall election campaign, and tensions in the Middle East loom.

Charles Sherry, M.Sc. is an experienced financial writer with a passion for exploring the markets and enhancing client communication. In his 25 years in the industry, he authored the Schwab Market Update and works extensively with financial advisors. Charles provides engaging and timely content for newsletters and blogs that help advisors connect with clients and increase their visibility.

IMPORTANT NOTICE

This material is provided exclusively for use by Horsesmouth members and is subject to Horsesmouth Terms & Conditions and applicable copyright laws. Unauthorized use, reproduction or distribution of this material is a violation of federal law and punishable by civil and criminal penalty. This material is furnished “as is” without warranty of any kind. Its accuracy and completeness is not guaranteed and all warranties express or implied are hereby excluded.

© 2024 Horsesmouth, LLC. All Rights Reserved.

Investment Advisor Representative of and Advisory services offered through ORG Partners, a SEC Registered Investment Advisor. Abmeyer Wealth

Management, LLC. is a DBA of ORG Partners. For a copy of our Form CRS, it can be found here: ORG-Partners-Form-CRS-0322.pdf (twentyoverten.com)